What is Form EAEC. EA Form in PDF Download.

It is the employers responsibility to ensure that their employees receive these forms.

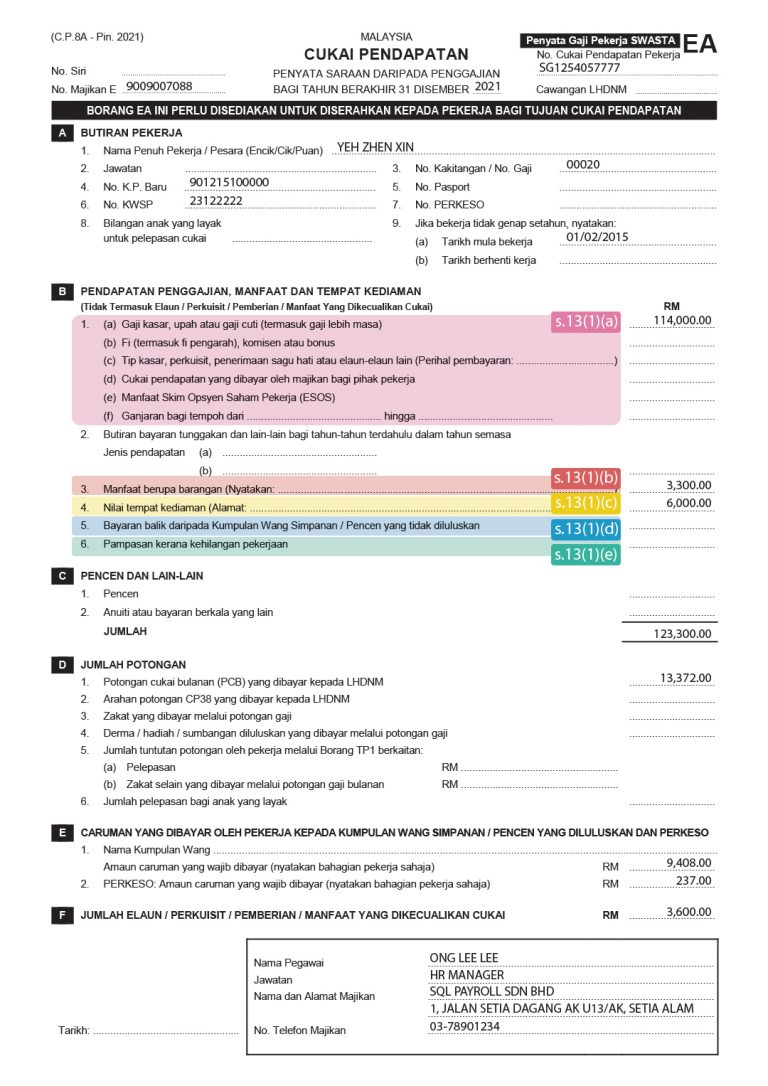

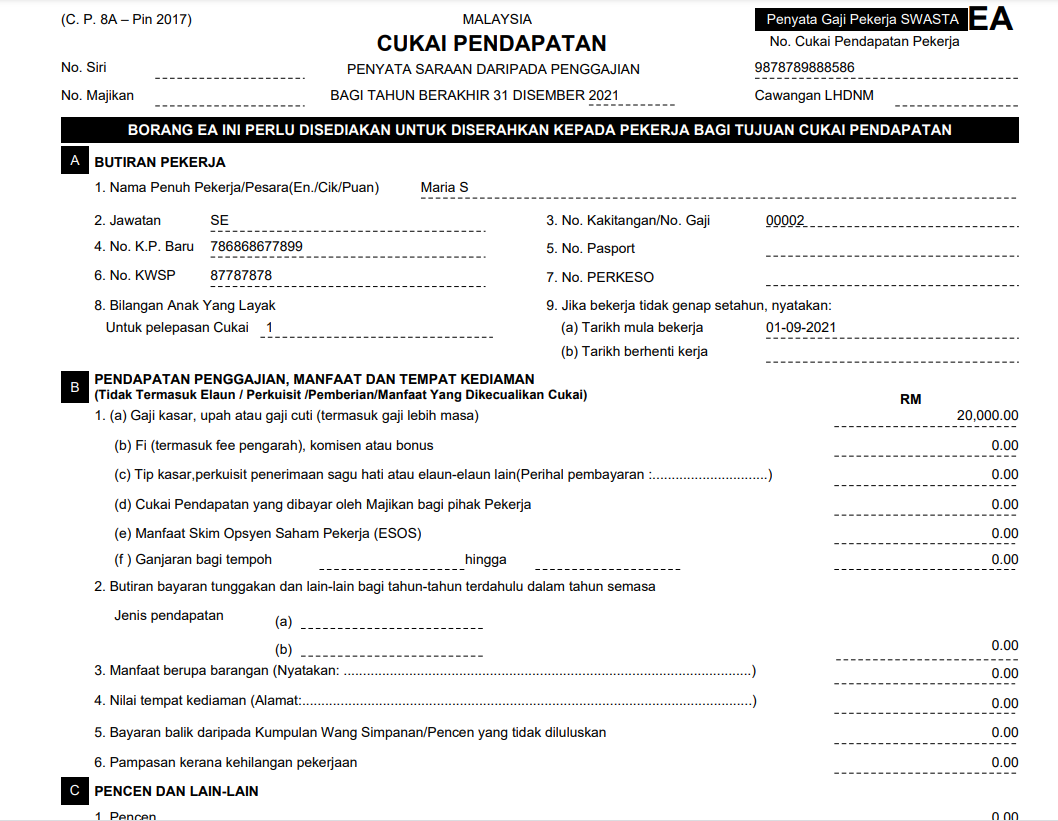

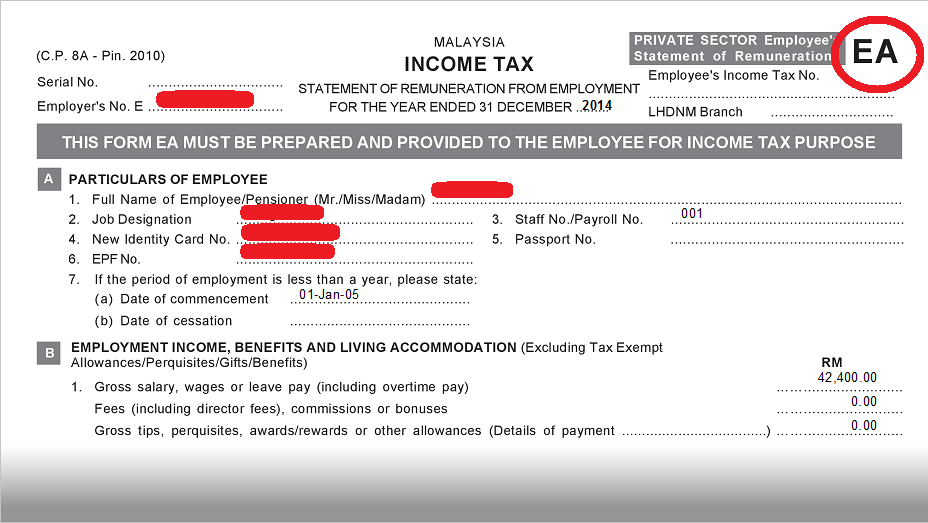

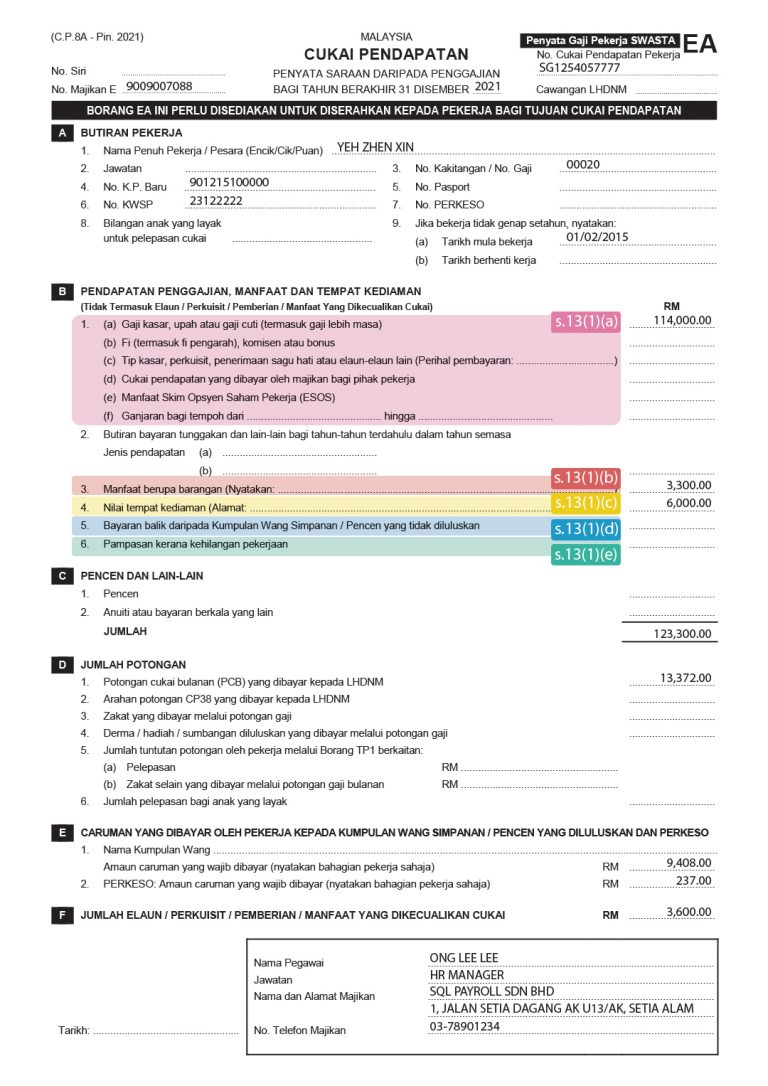

. Form E field by the employer is in fact where. Line 22 on Form 1040 gives you the effective tax rate if you divide your tax liability by the total income or 8 if you are single. In accordance with subsection 831A of the Income Tax Act 1967 ITA 1967 the Form CP8A CP8C must be prepared and rendered to the employees on or before end of February the following year to enable them to complete and submit their respective Return Form within the stipulated period.

On and before 3042022. EA Form in Excel Download. What Is Form E Malaysia.

This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved. EA Form is given by Company. Once u login the on-line BE Form is ready for you to fill in and make amendments etc.

What is Form EA. Select 2021 as the year and click Download CP8D. How Is Statutory Tax Rate Calculated.

Many of the Income Tax related forms are quite difficult to find. Salaries wages allowance incentives etc to be included in the CP8D form. In Part F of Form EA you can file for tax exemptions for certain benefits-in-kind that can reduce your.

As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b. The EA Form is a statement of remuneration for private employees. This year you might find yourself being directed to a brand new login user interface login from here.

What if you fail to submit Form E. What is EA Form. Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022.

Who need to file the Form E. Furthermore youll want to ensure that you file the form online. What Is EA Form In Malaysia.

According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. 2021 malaysia income tax statement of remuneration from employment. Form BE is your tax Submission to IRB.

Have you prepared the Form EA for Employees. Click on Permohonan or Application depending on your chosen language. Wages salary remuneration leave pay fee.

Tax season is the time when personal taxes are filed on. What is Form EA. What is an EA form.

The Form E is a declaration report that employers submit to the IRB as soon as possible each year to inform them about the number of employees and the employees income. As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. Go back to the previous page and click on Next.

The deadline for 2020 is the 28th of February 2021. There are 3 types of TP forms created by the LHDN that have to be issued by employers. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

EA Form meaning according to Inland Revenue Board Of Malaysia. Failure to prepare and render EA Form to employees before last day of February fine of RM 200 to RM 20000 or imprisonment for a term not exceeding 6 months or both. The TP forms were made to guarantee that an employees PCB calculation is accurate.

If you do E-Filing. A once the Form has been submitted you will be. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year.

July 7th 2020 No Comments. An EA form is a report of employees salaries and statutory contributions paid for the past year. In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable income.

It includes your previous years salary. Every employer must provide his employee with their EA Form by the last day of February. This employees statement of remuneration is also widely known as EA Form which shows the details of all employment income paid to each individual employee including the amount contributed to approved pension funds and tax deducted.

Download a copy of the form and fill in your details. How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2021 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. What are TP 1 TP 2 TP 3 forms in Malaysia.

What is Form E. The following information are required to fill up the Form E. Click on e-Filing PIN Number Application on the left and then click on Form CP55D.

Part F of Form EA is where you can file for tax exemptions on certain perquisites and benefits-in-kind thereby reducing your overall chargeable income. Employers have to prepare and distribute the EA Form before the last day of February every year. EA Form and CP8D forms are available in both English and Malay versions but the Excel versions are only available in.

Go to PayrollFormsForm E. This form ea must be prepared and provided to the employee for income tax purpose cp8a - pin. 47800 Petaling Jaya Selangor Malaysia.

Download 2021 EA Form. You will get 2 text files one starts with P one starts with M. By far the majority.

Once you register for E-Filing you will be given a password username. Section 83 1A Income Tax Act 1967. Use the text file starts with P and get ready to upload it into LHDN website.

Its important to understand the various benefits-in-kind as well as. We have located the specific links to these forms for easy download. Hence anyone can actually fake an EA Form.

Unlike Form E employers do not need to submit EA Form to IRB.

What Is Form E Form Ea Form Ec Asq

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

What Is Form Ea Part 1 Defining The Benefits In Kind

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Ea Form Malaysia Form Ead Faveni Edu Br

St Partners Plt Chartered Accountants Malaysia Form Ea 2020 Statement Of Remuneration From Employment For Private Sector This Form Ea Must Be Prepared And Provided To The Employee

Ea Form Sample Image From Actpayroll Com Cilisos Current Issues Tambah Pedas

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Understanding Lhdn Form Ea Form E And Form Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

How To Step By Step Income Tax E Filing Guide Imoney

Ea Form Malaysia Form Ead Faveni Edu Br

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

Function Added For Excel Users To Do Ea Form Actpay Payroll